Company Valuation & Financial Modeling

Why take this course?

🚀 Welcome to Mastering Company Valuation & Financial Modeling! 🌟

Hey, welcome to our very popular Company Valuation and Financial Modeling online course! This is where your journey towards becoming a finance expert begins!

We are thrilled to have you here. If only we could meet in person right now and welcome you with a handshake! 🤝

What's this course all about?

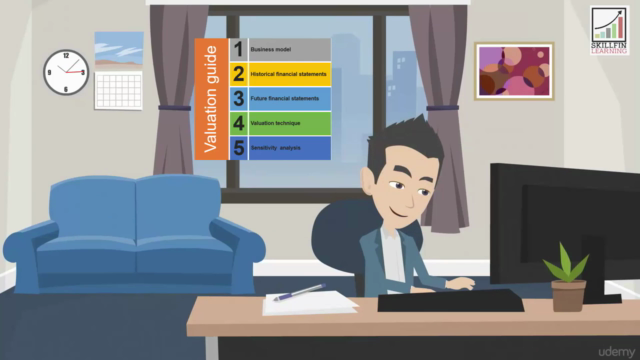

This comprehensive course is designed to equip you with the essential skills needed to perform a thorough company valuation. Here's what you'll learn:

- Understanding the Business Model: Dive into the core of the business, its operations, and market positioning.

- Financial Statements Mastery: Get hands-on experience with preparing accurate Income Statements, Balance Sheets, and Cash Flow Statements.

- Forecasting Financial Statements: Learn to predict future financial performance and understand the levers that drive business success.

- Discounted Cash Flows (DCF): Master the DCF valuation technique, a cornerstone in business valuations.

- Sensitivities Analysis: Understand how changes in key assumptions affect your valuation estimates and make informed decisions.

This course is extremely comprehensive and will prepare you for any company valuation task you might face. 🏗️💼

How can this course transform YOUR career?

Watch our promo video to get a glimpse of what you're about to learn!

This course is your golden ticket to an Analyst role in:

- Investment Banking: Gain the insights needed to advise on mergers, acquisitions, and capital raises.

- Equity Research: Learn to evaluate companies for potential investment opportunities.

- Private Equity: Understand the intricacies of investment strategies in private markets.

- Asset Management: Master the skills to manage and allocate investments on behalf of clients.

- Consulting / Advisory: Provide expert guidance to businesses on financial decisions and strategy.

The Analyst position is crucial in all these sectors, and our course is tailored to ensure you're job-ready from day one! You'll be prepared to tackle real-world projects and impress your future employers with your analytical prowess. 📈💪

Lifetime Access & Practical Training

By enrolling in this course, you get unlimited access for as long as the content exists – that means you can come back to it anytime, even if you start later! Plus, the practical training is unparalleled. You'll work through real-life illustrations and practice assignments across various difficulty levels, ensuring you're not just learning but applying your knowledge effectively. 🛠️✨

Interactive & Engaging Learning

Our course stands out due to its hands-on approach. You'll follow along with the instructor using the same spreadsheets provided for download. It's like having a personal mentor guiding you through every step! The engaging delivery and helpful practice activities are designed to keep you interested and make learning fun. 🎓🚀

Real Student Feedback

Don't just take our word for it – listen to what students like Daniel Hughes have to say:

"I found the information valuable, the explanations clear, and the delivery engaging. The practice activities were helpful, the course description accurate, and the instructor knowledgeable." – Daniel Hughes

For more success stories, head over to our reviews section.

Satisfaction Guarantee

We're so confident you'll love this course that we offer a 30-day money-back guarantee. If for any reason you're not satisfied, we'll refund your purchase – no questions asked. 🏦💖

Take the Next Step

Any lingering doubts? Our team is always here to help! Don't hesitate to reach out with your questions. Start learning now and join us inside the course. We can't wait to see you thrive in the world of finance! 🌐🎉

Enroll Now and take the first step towards an exciting, rewarding career in financial analysis!

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

The Company Valuation & Financial Modeling course on Udemy boasts a strong 4.52 global rating and has garnered positive reviews from over 23,000 subscribers since its inception in 2017. The course excels at offering comprehensive financial modeling techniques and business valuation strategies for finance professionals. Despite minor issues regarding pacing and inconsistencies between provided materials, the overall quality of instruction and practical applicability enable learners to perform robust financial analysis and make informed investment decisions.

What We Liked

- The course offers a comprehensive overview of company valuation and financial modeling, covering key topics such as discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions.

- Instructors excel at breaking down complex ideas into digestible parts, making the content accessible to learners with varying levels of financial background.

- Hands-on exercises and real-world case studies are effectively integrated throughout the course, ensuring a balance between theoretical knowledge and practical application.

- Learners appreciated the step-by-step instructions on model construction and the opportunity to follow along and comprehend rationales in depth.

Potential Drawbacks

- The course primarily focuses on forecasting financial statements using a single method, leaving out other approaches such as the Income Multiplier Method and Dividend Discount Model (DDM).

- Some learners expressed that certain aspects of valuation, like calculating WACC components or analyzing annual reports, could benefit from more detailed explanations.

- Minor discrepancies between provided Excel files and instructor-demonstrated examples were noted, causing slight confusion for some users.

- While suitable for beginners, a few learners found the pace to be slow at times and would have preferred a quicker progression through basic concepts.