The Securities Trade Lifecycle: Front, Middle & Back-Office

Why take this course?

🌟 Course Title: The Securities Trade Lifecycle: Front, Middle & Back-Office 🚀

📘 Headline: Definitive Trade Lifecycle Guide | Trade Execution | Capture | Enrichment | Confirmation | Settlement | Reconciliation 🏦

About the Course:

Embark on a comprehensive journey through the securities trade lifecycle with our expert-led online course. Designed to provide you with an in-depth understanding of the operations behind capital markets transactions, this course is your key to mastering the intricate steps from order initiation to settlement and reconciliation. 📈

Course Breakdown:

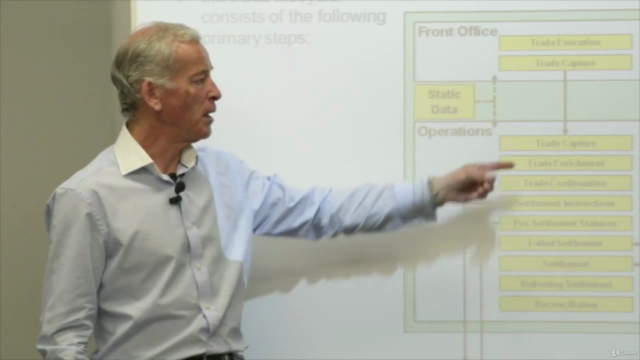

🔥 Front Office Functions:

- Order Initiation and Delivery

- Risk Management and Order Routing

- Order Matching and Trade Conversion

🔍 Back Office Functions:

- Affirmation and Confirmation

- Clearing and Settlement

Your Instructor:

Meet Mike Simmons, the World's leading securities operations expert. With decades of experience managing large-scale security operations for major money center banks, Mike's real-world insights will bring the concepts to life. His hands-on approach in capital markets and risk management is unparalleled, making him a globally recognized authority on this subject. 🏅

What You'll Learn:

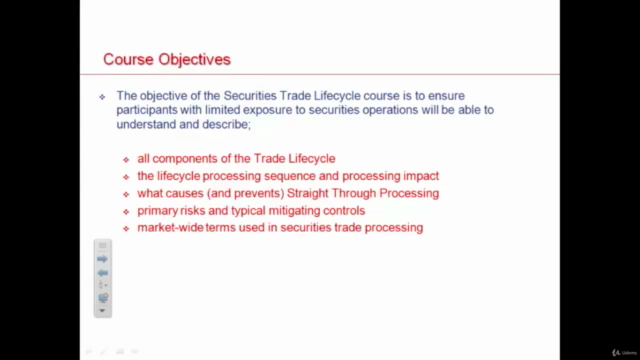

- Detailed Trade Lifecycle: Gain a granular understanding of each step in the trade lifecycle from a back-office perspective.

- Expert Guidance: Learn from Mike, who has conducted over 500 training courses worldwide and authored three industry-renowned books.

- Real-World Applications: Apply practical knowledge to real-world scenarios with case studies and examples drawn from Mike's extensive experience in the field.

About Starweaver:

Starweaver, your trusted educational partner, has been at the forefront of financial industry training for years. Renowned for its top-tier instructional content, Starweaver has empowered employees from leading financial institutions and technology companies, including Ahli United Bank; Mashreqbank; and HSBC, to name a few. 🎓

Why Choose Starweaver?

- Expertise: Benefit from the collective knowledge of seasoned financial industry professionals with over 20 years of experience.

- Global Reach: Join thousands of learners who have enhanced their skills through Starweaver's training programs, delivered across continents.

- Comprehensive Learning: Access a wide array of learning materials tailored to different levels of expertise and roles within the financial industry.

Ready to Dive In?

Whether you're seeking to expand your knowledge, enhance your career prospects, or simply gain a better understanding of how securities transactions work behind the scenes, this course is your gateway to mastering the intricacies of the trade lifecycle. 🎮

Take the Next Step:

Don't wait to unlock the secrets of the securities trade lifecycle. Enroll in this comprehensive online course today and join a global network of financial experts who have transformed their understanding with Starweaver's guidance. 🚀

Enroll Now and Transform Your Financial Knowledge! 🌟

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

The Securities Trade Lifecycle: Front, Middle & Back-Office serves as an excellent foundational resource for those new to investment banking or trade lifecycles. While minor technical issues and content redundancy can be improved, the course overall excels in clarifying concepts with live whiteboard explanations, illustrative examples, and emphasis on risk management throughout. Enhancements focusing on the latest industry trends and practical aspects of custodians and stock exchanges would further elevate its effectiveness to meet modern standards.

What We Liked

- Covers the entire trade lifecycle, from initiation to settlement and reconciliation

- Instructor provides clear explanations and uses a live whiteboard to illustrate concepts

- Highly useful for individuals with no prior knowledge or those starting their careers in investment banking

- Comprehensive examples and illustrations facilitate learning

- Addresses risk management strategies throughout the trade lifecycle

Potential Drawbacks

- Some technical issues, such as camera focus on instructor instead of slides and poor video quality at times

- Lacks updated information on recent technology and tools in the industry (as of 2022)

- Missing practical explanations regarding custodians from a client perspective, public trading accounts, and stock exchange functions

- Minor redundancy in content and course length could be reduced