The Complete Personal Finance Course: Save,Protect,Make More

Why take this course?

🌟 Welcome to The COMPLETE Personal Finance Course! 🌟

I'm thrilled to introduce you to what I assure you is THE most thorough personal finance course available ANYWHERE on the market - and I stand by it with a 30 day money back guarantee. This course, designed by an award-winning MBA Professor from Columbia University, former Goldman Sachs employee, and bestselling Udemy professor, Chris Haroun, is tailored for every country and currency around the globe. It's not just one course; it's 3 courses in 1: Save, Protect, and Make more!

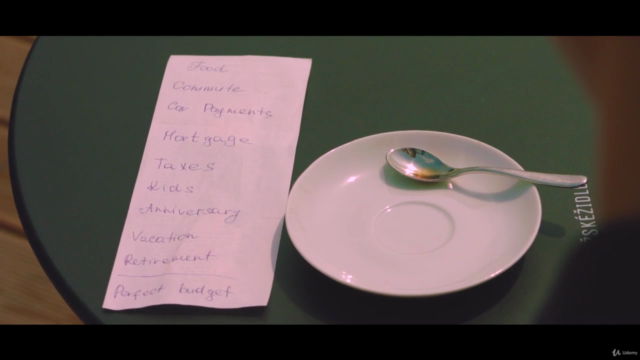

💸 Savings & Protection: You'll learn the essentials of creating a solid foundation for your financial security. With real-life strategies and practical exercises, you'll understand how to manage your finances effectively.

🚀 Investment & Growth: Dive into the world of investing with guidance on stocks, bonds, commodities, real estate, and more. You'll learn how to create a diversified investment portfolio that works for you.

💰 Practical Tools & Resources: This course is packed with tools and resources designed to make your financial journey as smooth and successful as possible. You'll get hands-on experience with an included Complete Personal Finance Excel dashboard exercise file, perfect for those with little to no Excel experience.

🎓 Comprehensive & Interactive: Each lesson comes with closed captions for your convenience, ensuring that you can learn at your own pace and style. The interactive exercises are based on real-life scenarios, not just theoretical knowledge.

👍 No Prior Experience Needed: Whether you're a novice or looking to refine your skills, this course is designed for all levels. You don't need advanced Excel skills or accounting experience to get started.

🎉 What You'll Achieve:

- Master the principles of personal finance.

- Learn investment strategies that work.

- Use a practical Excel dashboard to track and manage your finances.

- Make informed decisions to save, protect, and grow your wealth.

🎁 Special Offer: As a token of my commitment to your success, I'm offering you a comprehensive course with an Excel exercise document that will become your roadmap for financial success.

💰 Satisfaction Guarantee: If you don't find this course valuable, I offer a 30 day money back guarantee. There's no risk in taking the next step towards financial literacy and empowerment.

Ready to transform your personal finance skills? Click the "Take This Course" button and embark on a journey to improve your ability to save, protect, and make more with your finances. Let's get started!

Thanks for choosing this course, Chris Haroun

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

The Complete Personal Finance Course: Save,Protect,Make More offers a well-rounded perspective on improving your financial health and understanding investments. While the course is mainly aimed at beginners, make sure you are comfortable with its generally focused approach and take advantage of the opportunity to customize your Excel dashboard for personalized savings strategies. You'll come away from this Udemy bestseller better equipped to navigate your finances and plan for long-term wealth.

What We Liked

- The course provides a comprehensive overview of personal finance, covering various ways to save, protect, and make more money.

- Actionable tips and exercises are given that helped learners save an average of €52 per month without feeling like they sacrificed anything.

- The instructor is knowledgeable, clear, and engaging, making the course easy to understand even for beginners.

- The course includes valuable information about investments, risk management, and diversification strategies.

Potential Drawbacks

- Some learners find the course overly generic or too focused on the US/Canadian market, while lacking specifics that cater to other regions and tax systems.

- A few found the Excel-based exercises time-consuming and preferred the use of dedicated software or online tools.

- The extensive scope might be overwhelming for some learners; a more focused approach on specific topics may have been beneficial.