The Complete Financial Statement Analysis Course

Why take this course?

🌟 Unlock the Secrets of Financial Statements with The Complete Financial Statement Analysis Course! 🌟

Are You Ready to Master Financial Analysis Like a Pro? 🚀

Course Headline: 📈 Financial Ratio and Financial Statement Analysis Tools for Value Investors! Includes Case Studies with Excel Examples.

Course Description:

Ever wondered how top investors like Warren Buffett, David Einhorn, or Jim Chanos consistently outperform the market? Their secret weapon isn't just luck—it's industry-leading financial statement analysis skills that reveal hidden opportunities and risks. 🔍

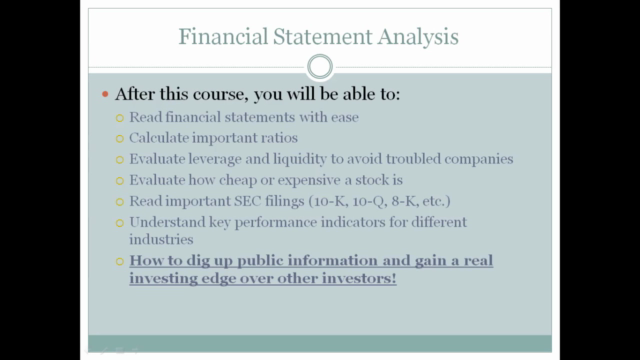

A Lot More Than Just Ratios: While many courses merely scratch the surface by teaching a few basic financial ratios, true financial statement analysis is an art that involves a deeper understanding of reading, research, and analytical strategies. This course will give you a real investing edge with comprehensive analytical skills. 🏋️♂️

Why You Should Enroll in This Course:

-

Expert Instructor: With a Bachelor’s degree in accounting and finance, and years of equity research experience at blue chip hedge funds, your instructor is not just teaching—they're a seasoned pro sharing real-world insights. 🎓

-

Complete Training: This course covers all the essential topics for financial analysis, including a detailed walk-through of SEC filings and what critical information to look out for. You won’t find this level of detail elsewhere! 📚

-

Real World Examples: Learn through practical case studies and immediately apply what you've learned to your own career or investment goals. These aren't hypothetical scenarios—they're from the trenches of financial analysis. 🌐

-

Exceptional Support: Have questions? Your instructor is committed to providing prompt answers and support to ensure your learning experience is as effective as possible. 🤝

-

Industry Secrets Revealed: Uncover tricks and tips that even veteran investors might not be aware of, giving you an edge in the competitive world of finance. 📈

What Sets This Course Apart:

-

Applicable Knowledge: Learn how to read and analyze financial statements with practical tools like Excel, which is crucial for making informed decisions. 📝

-

Engaging Content: With a blend of video tutorials, real case studies, and hands-on exercises, you'll stay engaged and eager to learn. 🎥➡️🏫

-

Interactive Learning: Engage with fellow students and your instructor through discussions and Q&A sessions to enhance your learning experience. 🗨️

Bonus Features:

- Money-Back Guarantee: With Udemy's 30-day money-back guarantee, you can take this course with confidence, knowing that your investment is risk-free. If you don’t learn something valuable, you get your money back. No questions asked! 💰➡️✅

Course Highlights:

-

Knowledgeable Instructor: Years of equity research experience and a solid academic background.

-

Comprehensive Training: Covers main topics, SEC filings, and practical applications of financial analysis.

-

Real World Case Studies: Learn with scenarios directly from the financial industry.

-

Excellent Support: Get answers to your questions promptly from a dedicated instructor.

-

Industry Insights: Gain access to insider strategies and tips that can provide you with an edge over others in finance.

Don't miss out on this opportunity to elevate your financial analysis skills! 📊💼 Whether you're an aspiring investor, a current analyst, or anyone looking to gain a deeper understanding of financials, this course will equip you with the knowledge and tools you need to succeed. Enroll now and step into the world of expert financial statement analysis! 🎓🚀

Course Gallery

Loading charts...