The Advanced Real Estate Financial Modeling Bootcamp

Why take this course?

🌟 Unlock the Secrets of Advanced Real Estate Financial Modeling with Our Expert-Led Bootcamp! 🏡💼

Course Headline: The Complete Guide to Advanced Real Estate Financial Modeling for Real Estate Investors and Industry Professionals

Master real estate financial modeling. Advance your career. Make more money.

Dive into the world of advanced real estate financial modeling with our comprehensive course, meticulously crafted by Justin Kivel—a seasoned expert with a wealth of experience from some of the top firms in commercial real estate. Whether you're aiming to secure a position at a prestigious firm, elevate your career path within the real estate sector, or keen on mastering financial modeling to enhance your own property investment portfolio, this course will empower you with expert-level skills.

About Your Instructor:

Justin Kivel has spent nearly a decade honing his expertise in commercial real estate investment, brokerage, and lending. His passion for education led him to establish Break Into CRE, where he's successfully trained tens of thousands of students in the art of real estate financial modeling and analysis.

Course Highlights:

This course is a treasure trove of advanced financial modeling techniques, including:

- Dual-Metric Data Tables: Learn to sensitize multiple investment return metrics simultaneously within your analyses to understand their impact clearly.

- Best/Base/Weak Case Analysis: Master the art of creating dynamic models that automatically calculate returns for different investment scenarios.

- Next-Buyer Analysis Projection: Project sale values at the end of a real estate investment to inform your decision-making process.

- Investment Cash Flow Distribution: Model cash flows on a monthly, quarterly, and annual basis to gain insights into your investments' performance over time.

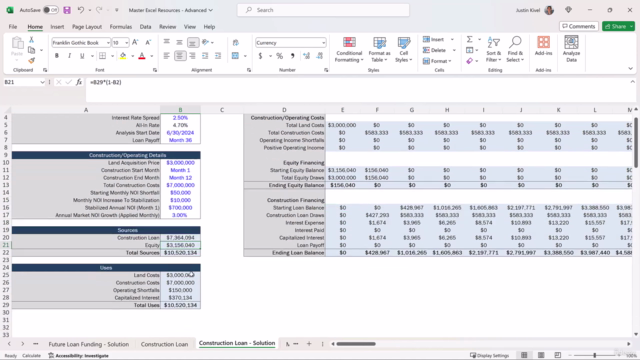

- Senior & Mezzanine Construction Loan Draws: Understand the intricacies of modeling unique capital structures for ground-up development deals.

- Hold/Sell Analysis: Calculate the optimal sale year for an investment to maximize your returns.

Who Is This Course For?

- College & Graduate Students: Stand out in your field by mastering Excel modeling and analysis before you hit the job market.

- Real Estate Professionals: Elevate your career by adding advanced financial modeling to your skill set.

- Real Estate Investors: Analyze complex deal scenarios with confidence and make informed investment decisions.

Student Testimonials:

Our students rave about the practical knowledge they gain from this course:

★★★★★ "This course is extremely advanced, but incredibly rewarding. The case study at the end was a fantastic way to tie all the concepts together. It's definitely worth the effort!"

★★★★★ "Justin's didactic approach and in-depth explanations made this complex topic very understandable. I feel much more confident in my ability to analyze investments now."

★★★★★ "As a CRE beginner, this course has exceeded my expectations. It's clear that Justin is an expert in the field, and his guidance has been invaluable."

Course Outcome:

If you have a foundational grasp of real estate finance and Excel, this bootcamp is your gateway to mastering advanced financial modeling techniques that will set you apart in the competitive world of commercial real estate.

Enroll Now!

Take the first step towards transforming your career by enrolling in our Advanced Real Estate Financial Modeling course today. Elevate your expertise, command higher rates, and achieve your professional goals with the confidence that comes from mastering these essential skills. 🚀📈

Don't miss out on this opportunity to excel in real estate financial modeling—where your success is our mission! Join us now and elevate your career to new heights! 🌟

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

The Advanced Real Estate Financial Modeling Bootcamp offers an extensive exploration of advanced modeling techniques and formulas tailored toward the real estate industry. While some may find the content repetitive, the course excels in providing real-world insights, comprehensive examples, and expert instruction addressing complex development projects and debt structures. This Udemy course is particularly valuable for those preparing for real estate deals-focused roles or seeking to deepen their understanding of institutional practices.

What We Liked

- In-depth coverage of advanced real estate financial modeling concepts, including development projects, major renovation projects, and complex debt and equity structures.

- Highly responsive instructor who patiently answers questions and clarifies concepts.

- Well-structured, hands-on approach that provides a valuable skill set and in-depth industry knowledge.

- Excellent resource for improving understanding of institutional world norms and common practices.

Potential Drawbacks

- Some find the content repetitive or dry, particularly when dealing with similar Excel formulas and timeframe checks.

- Could benefit from tying concepts back to market practice more often.

- May require prior knowledge of real estate finance basics for optimal comprehension.