CAIIB Advanced Bank Management (Part I)

Why take this course?

🏆 Master Advanced Bank Management with CAIIB Advanced Bank Management (Part I) 🎓

Course Description:

Are you aspiring to ace the CAIIB examinations and take a giant leap in your banking career? Look no further! Our comprehensive online course, meticulously crafted by the expert Raja Natarajan, is designed to equip you with an in-depth understanding of Module A & B of the Advanced Bank Management paper. As a CAIIB aspirant, this course will be your ultimate guide to master the compulsory subjects as per the IIBA syllabus.

📚 What You Will Learn:

Module A:

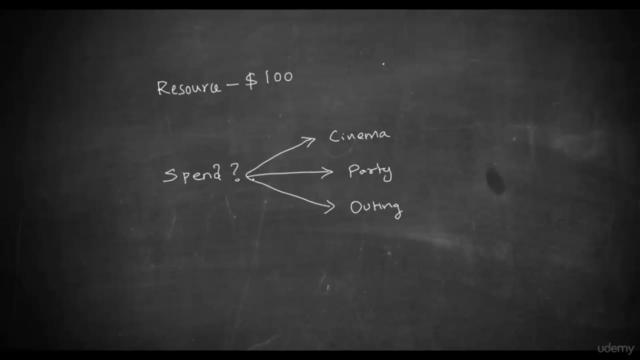

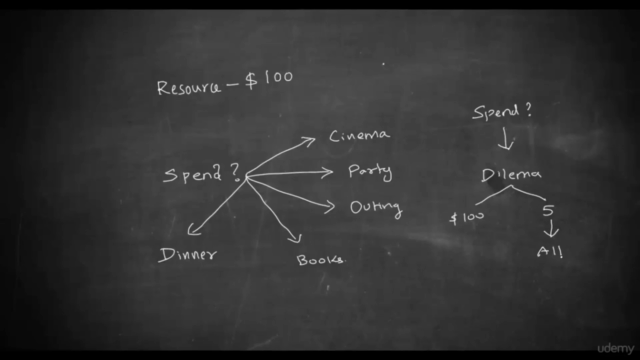

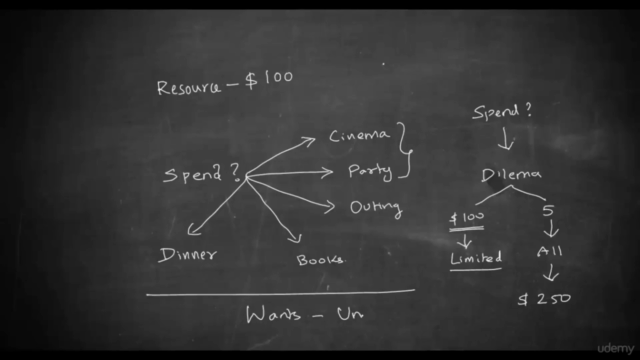

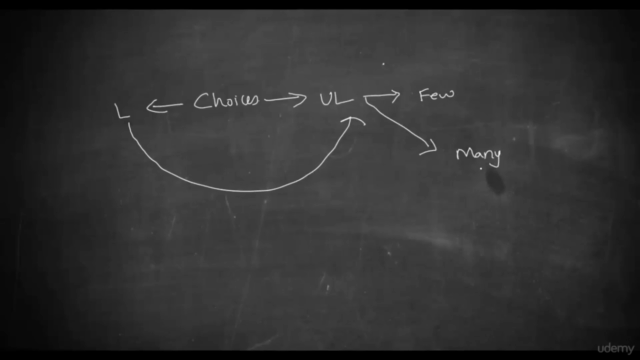

- 🌍 Introduction to Economics: Lay the foundation of your economic knowledge with an overview of key concepts and their relevance in banking.

- ✍️ Economic Laws and Analysis: Gain insight into how economic principles influence decision-making within financial institutions.

- 💼 Business Economics: Explore the economic aspects that drive business operations, market dynamics, and their impact on bankable sectors.

- 🎫 Different Markets and Price Determination: Understand the various markets and the factors that set prices in different economic conditions.

- 💰 Budget and Budget Line: Learn to prepare budgets and comprehend how these affect financial planning and management.

- 📈 Elasticity of Demand: Master the concept of elasticity and its implications for a bank's product pricing and customer base.

- 💰 Cost and Revenue Analysis: Analyze the cost structures, revenue streams, and their interplay to enhance profitability and sustainability.

- 🌏 Indian Economy: Delve into the unique economic landscape of India and its implications for banking operations.

Module B:

- ⏰ Time Value of Money (TVM): Comprehend the concept of TVM and its significance in evaluating financial instruments.

- 💸 Discounted Cash Flow (DCF) Techniques: Learn to project future cash flows and make informed investment decisions.

- ✅ Net Present Value (NPV): Understand how NPV can be used as a tool for valuing projects and investments.

- 📊 Time Series Analysis: Analyze financial data over time to identify trends, patterns, and predict future outcomes.

- 📈 Mean / Median and Mode: Master the statistical concepts of central tendency and their applications in risk assessment and financial analysis.

- 📉 Standard Deviation / Dispersion: Learn to measure and manage the risk inherent in investment portfolios.

- 🔁 Correlation Analysis: Identify relationships between different variables that can influence financial outcomes.

- 📐 Regression Analysis: Predict future trends based on historical data, enhancing your decision-making capabilities.

- 🎲 Linear Programming (LP): Optimize resource allocation to maximize efficiency and profitability.

- 💡 Simulation: Understand the outcomes of various scenarios before making critical financial decisions.

🚀 Course Features:

- Self-Paced Learning: Learn at your own pace, with the flexibility to revisit concepts as needed.

- Engaging Video Lectures: Benefit from high-quality screen cast video lectures that bring complex topics to life.

- Digital Handwriting Notes: Visualize and grasp key concepts through meticulous handwritten notes on our digital board, offering a closer learning experience to traditional classroom settings.

- Ideal for CAIIB Aspirants: This course is tailor-made for those targeting the CAIIB exam, providing a laser-focused approach to acing it.

Embark on your journey towards becoming a Certified Associate of Indian Institute of Bankers (CAIIB) with confidence and expertise. Enroll in this course today and transform your career in banking and finance! 🌟

Course Gallery

Loading charts...