Intro to Analyzing Rental Income Properties

Why take this course?

It seems like you've provided a comprehensive overview of what a course on real estate investing analysis might offer, including the foundational topics covered, the practical applications, and the assurances of the value and focus of the content. The testimonials from past students add credibility to the course, and the FAQs address common concerns and misconceptions about what the course does and doesn't provide.

Here's a summary of what you can expect from such a course:

-

Foundational Knowledge: You'll learn the fundamental concepts of real estate investing analysis, including understanding market trends, property valuation, and financial modeling.

-

Real-World Application: The course will likely include detailed examples and case studies that demonstrate how to apply these concepts to both fix & flip and rental income properties.

-

Specialized Techniques: You'll gain insights into advanced investment analysis techniques such as the waterfall structure, which is a sophisticated method of allocating profits and losses in real estate deals.

-

Tools for Evaluation: The course will equip you with tools and frameworks to evaluate potential investments systematically.

-

Investment Mindset: You'll also be given guidance on building a mindset conducive to successful investing, including the use of affirmations and encouragement to pursue further learning opportunities.

-

No License or Personal Deals Evaluation: It's important to note that while the course will teach you how to perform investment analysis, it does not offer a Real Estate License or personal investment deal consultations.

-

Risk-Free Enrollment: With Udemy's 30-day money-back guarantee, there's minimal risk in enrolling and exploring the content to see if it meets your learning needs.

The course emphasizes that while it cannot make you rich, with diligent study and application of the knowledge gained, it can significantly enhance your ability to analyze real estate investment opportunities effectively. The promise is that by understanding these concepts and tools, you'll be well-equipped to make more informed decisions in your real estate investments.

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

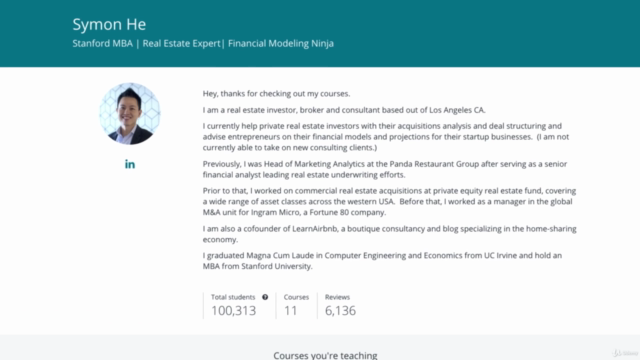

With 28427 subscribers and a global rating of 4.43, this Intro to Analyzing Rental Income Properties course by Symon offers thorough instruction for beginners looking to develop strong analytical skills around real estate investments. The course's primary benefit lies in its detailed exploration of professional-grade investment models using Excel spreadsheets, aiding learners in evaluating potential deals with confidence. However, users have found that additional expenses occur due to reliance on Microsoft Office and the lack of available data for specific markets such as South Africa; potential limitations include the absence of real-life examples of successful versus unsuccessful investments, requiring some users to seek alternative resources to gain practical context and experience.

What We Liked

- Comprehensive introduction to analyzing rental income properties, ideal for beginners or those looking to brush up on key concepts.

- In-depth exploration of professional-grade investment models and techniques using Excel, with downloadable resources provided.

- Covers various types of property analysis in a beginner-friendly manner, equipping learners with tools and knowledge to invest wisely.

- Leverages realistic examples to clarify complex topics, providing learners with insights into how the theories apply in practice.

Potential Drawbacks

- A few users mention the course's reliance on Microsoft Excel as an additional expense for some learners.

- Potential difficulties in finding specific information related to real estate markets and sold pricing (as is the case with the South African market)

- Lacks hands-on examples or video walkthroughs of real deals, making it challenging for learners to differentiate between good and bad investments.

- Additional research may be necessary on certain platforms or books to gain a better understanding of specific concepts introduced in the course.