Quantitative Finance & Algorithmic Trading in Python

Why take this course?

🌟 Dive into Quantitative Finance & Algorithmic Trading in Python! 🌟

Course Headline: Stock Market, Bonds, Markowitz-Portfolio Theory, CAPM, Black-Scholes Model, Value at Risk and Monte-Carlo Simulations

Course Description:

Welcome to the exciting world of financial engineering where mathematics and programming meet to unlock the secrets of the stock market and beyond. This course is meticulously designed to provide you with a robust understanding of the fundamental models that govern finance, with a special focus on Python as your tool for analysis and algorithmic trading.

Section 1 - Introduction:

- ✅ Python Setup: We'll start by installing Python and understanding why it's the language of choice for financial quantification.

- 🔍 Historical Data Challenges: You'll learn about the difficulties in working with historical data and how to overcome them.

Section 2 - Stock Market Basics:

- 💰 Present and Future Value: Grasp the concepts of present and future value of money, laying the groundwork for financial calculations.

- 📈 Understanding Stocks and Commodities: Explore stocks and shares, commodities, and the FOREX market to understand different investment vehicles.

- ⏰ Short vs. Long Positions: Learn how to navigate the complexities of short and long positions effectively.

Section 3 - Bond Theory and Implementation:

- 💼 Bond Essentials: Dive into what bonds are, their yields, durations, and how to price them accurately.

- 📊 Bond Pricing Theory: Implement the theory of bond pricing in Python with practical examples.

Section 4 - Modern Portfolio Theory (Markowitz Model):

- 🌱 Diversification: Discover the essence of diversification and how it can optimize your investment portfolio.

- 📐 Efficient Frontier and Risk/Return Analysis: Learn to plot efficient frontiers and understand the Sharpe ratio, capital allocation line, and more.

Section 5 - Capital Asset Pricing Model (CAPM):

- 🚀 Risk & Return Relationships: Analyze the relationship between systematic and unsystematic risks, market risk, betas, alphas, and linear regression.

Section 6 - Derivatives Basics:

- 🎫 Derivative Foundations: Gain an understanding of options (puts and calls), futures, credit default swaps, and interest rate swaps.

Section 7 - Random Behavior in Finance:

- 🔊 Random Processes: Explore the world of stochastic calculus, Ito's lemma, and brownian motion theory.

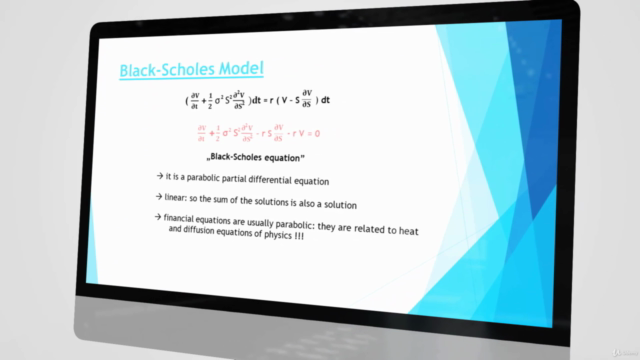

Section 8 - Black-Scholes Model:

- 📚 Model Theory & Application: Learn how to model financial instruments using the Black-Scholes equation and apply it in Python.

Section 9 - Collateralized Debt Obligation (CDO):

- ⚠️ CDOs Explained: Understand what CDOs are, their role in the financial crisis of 2008, and the importance of risk assessment.

Section 10 - Interest Rate Models:

- 🔄 Stochastic Processes & Bond Pricing: Study the Ornstein-Uhlenbeck process, Vasicek model, and other mean reverting processes with Monte-Carlo simulations.

Section 11 - Value Investing:

- 💎 Investment Strategies: Learn about long-term investment strategies, the efficient market hypothesis, and how to apply them using quantitative methods.

APPENDIX - Python Crash Course:

- 🧵 Python Basics: Cover variables, strings, loops, logical operators, and more.

- ⚫️ Functions & Data Structures: Master functions and explore lists, arrays, tuples, dictionaries, and data manipulation.

- 🚀 Object Oriented Programming (OOP): Understand the principles of OOP for structured coding practices.

- 📊 NumPy & Data Analysis: Utilize NumPy for numerical computations and data analysis in Python.

Join Us on this Quantitative Adventure!

Whether you're a beginner or an experienced trader looking to enhance your skills, this course will provide you with the tools and knowledge necessary to navigate the complex world of finance through the lens of quantitative analysis and algorithmic trading. 🚀

Let's embark on this journey together and turn data into profitable decisions! Enroll now and transform your financial future with the power of Python.

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

This course serves as an excellent starting point for those interested in quantitative finance, with its clear mathematical explanations and hands-on tutorials. However, be prepared to supplement your learning by updating the provided code, understanding stock analysis basics, and learning about algo trading from other sources. Furthermore, those seeking machine learning and algorithmic trading application might need to look for additional resources that delve more into these topics.

What We Liked

- High-quality course with educational value, providing a balance between mathematical explanations and hands-on tutorials.

- Clear and concise mathematical explanations that break down complex financial concepts for easier understanding.

- Thoughtfully designed hands-on tutorials, enabling students to build financial models using Python.

- Covers various essential topics in quantitative finance such as stock markets, bonds, portfolio theories, derivatives, and stochastic processes.

Potential Drawbacks

- Some users have criticized the misuse of the term 'algorithmic trading' and the lack of depth in certain areas.

- Concerns about excessive use of object-oriented programming (OOP), which may not appeal to all learners.

- Limited focus on machine learning, portfolio creation, and hands-on algorithmic trading experience.

- A few users have reported outdated code related to the Yahoo API and a lack of response from the instructor in the Q&A forum.