Python for Finance and Algorithmic Trading with QuantConnect

Why take this course?

🌟 Python for Finance and Algorithmic Trading with QuantConnect: Master the LEAN Engine 🚀

Course Overview:

Dive into the World of Financial Analysis & Algorithmic Trading with Python! 📈

Welcome to the ultimate online course that will transform you from a Python novice to a finance and algorithmic trading expert using QuantConnect's LEAN Engine. This comprehensive journey through financial analysis and algorithmic trading will equip you with in-demand real-world skills that are crucial in the fast-paced fintech industry.

What You Will Learn:

🚀 Python Fundamentals:

- Get up to speed with Python essentials, setting a strong foundation for your finance and trading projects.

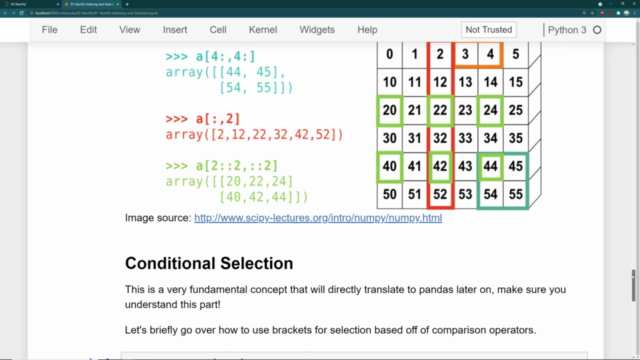

🔢 NumPy & Pandas:

- Master numerical processing with NumPy and data analysis with Pandas to handle large datasets with ease.

📊 Matplotlib for Data Visualization:

- Learn to visualize complex financial data with clear, impactful charts using Matplotlib.

💡 Financial Analysis:

- Perform in-depth stock returns analysis, understand volatility, risk, and explore concepts like EWMA (Exponentially Weighted Moving Average), Sharpe Ratio, and Markowitz optimization.

📈 Portfolio Allocation & Optimization:

- Discover how to optimize portfolio allocation using the efficient frontier and other powerful investment strategies.

💰 Types of Funds & Trading Strategies:

- Explore different types of funds, order books, short selling, and more to develop robust trading algorithms.

📉 Financial Theories & Models:

- Grasp complex financial theories such as the Capital Asset Pricing Model (CAPM), Stock Splits, Dividends, and the Efficient Market Hypothesis.

🤖 Algorithmic Trading with QuantConnect:

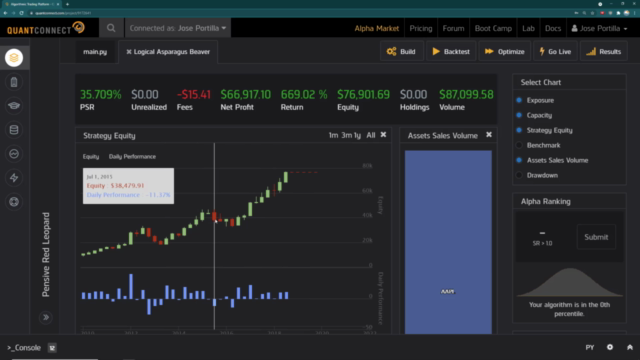

- Learn to implement your algorithms in live trading with real market data on the QuantConnect platform.

✨ And Much More!

Why Choose This Course?

✅ Tailored Libraries Coverage:

- Begin with a deep dive into Python's most popular libraries for financial data analysis and visualization, including NumPy, Pandas, and Matplotlib.

📽️ Hands-On Learning:

- Each lecture comes with high-quality HD videos, relevant theory slides, and full Jupyter Notebooks with step-by-step explanations.

🔍 Complete Coverage & Implementation:

- Unlike other courses, this one goes beyond theory and actually teaches you how to trade with your new skills.

🤝 Supportive Community:

- Engage with a vibrant online community in our QA Forums and Discord Server, alongside dedicated Teaching Assistants.

Course Highlights:

- Beginner to Expert Journey: Start with the basics and progress to advanced topics in Python for Finance and Algorithmic Trading.

- Real-World Skills: Learn skills that are highly sought after by employers in the fintech industry.

- Interactive Learning: Gain practical experience through Jupyter Notebooks, videos, and interactive discussions.

- Comprehensive Coverage: From financial concepts to executing trading algorithms live.

- Engaging Community: Access a supportive community for peer learning and networking.

- Risk-Free Trial: Try out the course with a 30-day money-back guarantee!

Don't miss this opportunity to elevate your skills in Python, Finance, and Algorithmic Trading. Enroll in "Python for Finance and Algorithmic Trading with QuantConnect" today and join the ranks of finance professionals who are shaping the future of trading with technology! 🌐💫

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

Python for Finance and Algorithmic Trading with QuantConnect is a comprehensive and engaging course that provides an in-depth look at Python libraries and financial analysis techniques. The course's main strength lies in the clear and concise teaching style, along with a thorough exploration of QuantConnect's capabilities. However, it falls short by not providing a full use case example and having outdated code snippets. Additionally, important derivatives trading topics are missing from the content. While this course still serves as an excellent starting point for learning about algorithmic trading, those interested in futures and options might need to look elsewhere.

What We Liked

- In-depth coverage of Python libraries and financial analysis techniques

- Excellent teaching style that's clear, concise, and engaging

- Thorough exploration of QuantConnect for backtesting and executing trade logic

- Well-structured course with straightforward explanations

Potential Drawbacks

- Lacks a full use case example using technical or fundamental analysis

- Some QuantConnect code in the videos is outdated

- Content for futures and options trading is not yet available in the course

- Exercises are spread far apart, making it difficult to retain information