Algorithmic Trading with Python: Technical Analysis Strategy

Why take this course?

🚀 Algorithmic Trading with Python: Master Technical Analysis Strategy!

Are you ready to take your Python skills and trading knowledge to the next level? 🧠✨ Whether you're a Python pro looking to diversify your income streams, a trading enthusiast eager to dive into algorithmic strategies, or simply curious about this cutting-edge field, Algorithmic Trading with Python is your gateway to success in financial markets!

Course Overview:

- Python Mastery: For beginners in Python, we've got you covered with a focused, condensed Python course to kickstart your journey. 🐍

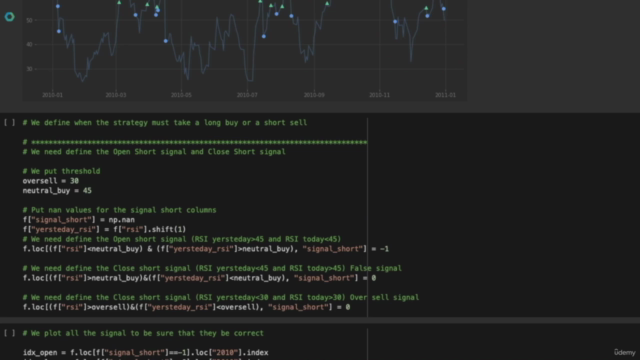

- Strategic Implementation: Learn to create and implement trading strategies from the ground up using Python, starting with one of the most popular technical indicators – the Relative Strength Index (RSI).

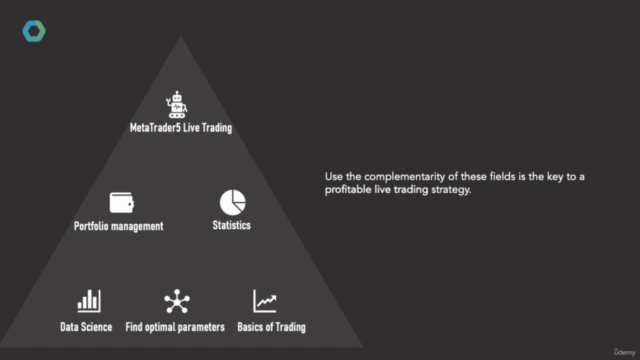

- Portfolio Optimization: Discover how to optimize your risk/return using advanced portfolio techniques like Sortino ratio optimization, min variance optimization, and Mean-Variance skewness kurtosis optimization. 📈

- Backtesting: Understand the importance of backtesting your strategies with vital statistics such as the Sortino ratio, drawdowns, and betas to ensure your strategy's robustness. 🔍

- Live Trading: Take your best algorithm live and experience the thrill of real-time trading. 💡

Course Highlights:

Tools & Techniques You'll Master:

- Live Trading Implementation

- Data Importation

- Reference Algorithms

- Backtesting Processes

- Risk Assessment of Stocks

- Financial Concepts (Long/Short Positions)

- Python Libraries (Numpy, Pandas, Matplotlib)

- Investment Diversification

- Performance Metrics (Sharpe Ratio, Sortino Ratio, Alpha & Beta Coefficients)

- Portfolio Optimization Techniques

Course Features:

- Real-World Application: This course is designed to give you practical, hands-on experience with algorithmic trading.

- Expert Insights: Learn from a finance expert with a deep understanding of the intersection between mathematics, economics, and machine learning.

- Community Support: Join our free Discord forum to ask questions or read insightful quantitative finance articles.

- Satisfaction Guarantee: We're confident in the quality of this course, which is why it comes with a satisfaction guarantee or your money back within 30 days.

What You'll Gain:

- A solid understanding of how to apply Python for technical analysis in trading.

- The ability to create and evaluate your own trading strategies.

- Knowledge of advanced portfolio optimization techniques.

- The confidence to backtest your strategies with real-world data.

- The skills to trade algorithms live on financial markets.

🎓 Embark on your journey into the world of Algorithmic Trading today! 🚀

Don't just learn Python or trading – combine both with expert guidance and hands-on experience to make informed, strategic decisions in the financial markets. Enroll now and transform your knowledge into profit with Algorithmic Trading with Python!

Course Gallery

Loading charts...