The Complete Guide To Multifamily Real Estate Investing

Why take this course?

🏢 The Complete Guide To Multifamily Real Estate Investing 🚀

Headline: The Step-By-Step Guide To Analyzing and Acquiring Multifamily Properties

Description:

Are you captivated by the world of commercial real estate, specifically multifamily properties? Whether your ambition is to land a lucrative role in real estate private equity, brokerage, or lending, or you're eager to invest passively in a multifamily deal – this course is your golden ticket! 🗝️

Why This Course?

-

Comprehensive Analysis Techniques: Gain the confidence and skills to analyze a multifamily acquisition opportunity using the same techniques as top global investment and development firms. 📊✨

-

Career Opportunities: Kickstart a promising career in real estate by learning the ropes from industry experts. The median total compensation for a multifamily acquisitions associate was $125K in 2021, according to CEL & Associates. 🤑💼

-

Invest with Confidence: Learn how to invest passively in multifamily deals with the ability to confidently analyze investment opportunities that align with your personal goals and investment objectives. 🏘️💰

What You'll Master:

-

Analysis Techniques: Master the art of analyzing a multifamily acquisition using techniques employed by leading private equity firms and institutions. 🔍📈

-

Career Skills: Build the foundation for a career in multifamily real estate at top investment management firms, where you can "get paid to learn." 🏢🎓

-

Investment Analysis: Evaluate passive investment opportunities with precision and clarity to ensure your investment fits your personal financial goals. 💡📊

Course Highlights:

-

Real-World Application: This course is designed to provide you with hands-on experience and practical tools you can apply immediately. 🛠️🏗️

-

Expert Guidance: Learn from Justin Kivel, a seasoned real estate investment instructor who specializes in multifamily properties. His expertise will guide you through the complexities of the industry. 🧠👩🏫

-

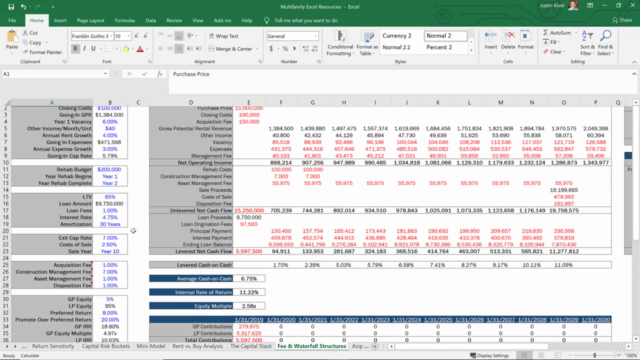

Tailored Resources: Access fully built-out Excel templates and comprehensive course materials that are ready for you to hit the ground running. 📑🖥️

Student Testimonials:

🚀 "This is my 3rd class with Justin, and this one might be the best. This was an awesome class that guided me through the entire process of acquiring a Multifamily Property." - 5 Stars

🌟 "Justin is a versed instructor of real estate who implements contextualization to drive his points home in the most concise and precise manner. His lessons are all relevant to today's real estate market and are interesting as well." - 5 Stars

📊 "I love how he has resources that help you through everything step by step, rather than just showing you how to use a pre-built model." - 5 Stars

💰 "The best real estate investing courses on Udemy! Justin does a great job of breaking things down into bite-sized pieces." - 5 Stars

🤝 "This course not only sharpened my perspective as a limited partner, but also provided me an understanding of a deal from both a sponsor and lender's point of view." - 5 Stars

Enroll Today! 🎉

Ready to embark on your multifamily real estate investment journey? Don't wait any longer – enroll in "The Complete Guide To Multifamily Real Estate Investing" now and transform your financial future. Let's dive into the world of multifamily investments together! 🏘️🌟

Enroll now and unlock the door to success in real estate! 🗝️🚀

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

The Complete Guide To Multifamily Real Estate Investing provides a solid foundation in understanding this rewarding investment sector. Covering all stages, essential skills, practical techniques, and expert knowledge—it's no surprise the course maintains an excellent 4.68 out of 5-star rating globally. Although there is room for improvement, primarily in presentation style and detailed differentiation for varying proficiency levels, students generally find value in its content.

What We Liked

- The course offers a comprehensive guide to multifamily real estate investing, covering professional underwriting and analysis techniques, institutional-quality pro forma acquisition models, risk identification, and debt & equity financing strategies.

- Many students appreciate the practicality of the course, with downloadable Excel sheets that demonstrate calculations and perspectives for various roles in investments.

- Real-life reviewers find value in the instructor's expert knowledge, expressing gratitude for his willingness to engage with students through answering questions and providing clear explanations for complex topics.

- A few students remarked on how this course refreshed their memory or served as a foundational education in real estate private equity and multifamily investing.

Potential Drawbacks

- Some students might expect specific information that seems missing from the course's description. For example, one student wished for an exclusive section of Excel-oriented videos and workbooks.

- Few students find the narration/intonation off-putting in the beginning but eventually get used to it.

- Despite a thorough curriculum, some reviewers mention difficulty understanding concepts or grasping certain specifics within the course content. Others comment on the typeface size of Excel files being too small for easy viewing.

- A few advanced students might not benefit as much from foundational and refresher materials.