Monte-Carlo Backtesting for Algorithmic Trading Strategies

Why take this course?

🚀 Course Title: Mastering Monte Carlo Backtesting for Profitable Trading Strategies

🔥 Headline: Unlock the Secrets of Trading Greatness with Monte Carlo Backtesting!

🤓 Description:

Are you an aspiring or seasoned trader eager to fortify your strategies against the vicissitudes of the market? Look no further! In "Mastering Monte Carlo Backtesting for Profitable Trading," Dr. Ziad Francis, a renowned course instructor, introduces you to the art and science of backtesting with unparalleled precision. This transformative online course is your gateway to mastering Monte Carlo simulations, trade resampling, and data-driven decision-making.

By embracing the techniques taught in this course, you'll learn how to stress-test your trading ideas against a myriad of market conditions, ensuring robustness rather than relying on serendipitous streaks of performance. With a deep dive into Monte Carlo simulations and other cutting-edge quantitative methods, you'll refine your strategies to achieve long-term profitability in both quantitative and algorithmic trading.

🎓 Key Highlights:

-

✅ Foundations of Monte Carlo Method: Grasp the fundamentals of synthesizing price paths to forecast potential performance outcomes under a variety of market conditions.

-

✅ Robust Strategy Development: Learn the best practices in backtesting to uncover hidden weaknesses and steer clear of overfitting, which can undermine your strategy's long-term success.

-

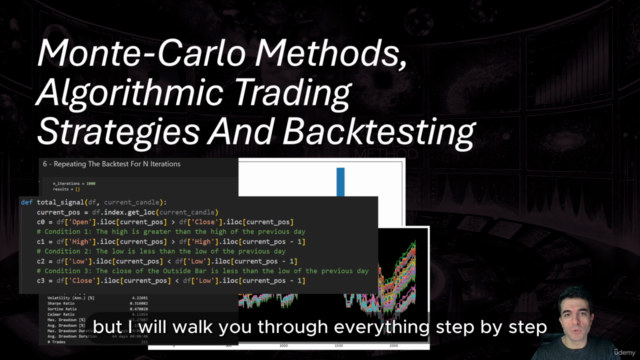

✅ Practical Implementation: Dive into Python code snippets that you can use for trade-level bootstrapping and risk modeling, providing hands-on experience in implementing Monte Carlo backtesting techniques.

-

✅ Advanced Stress Testing: Integrate parameter perturbations and regime shifts into your strategy to test its viability amidst market shocks and volatility.

-

✅ Real-World Applications: Gain insights from case studies that showcase how Monte Carlo simulations can enhance your understanding of market dynamics, improve the robustness of your strategies, and empower your trading decisions.

🌟 Why Choose This Course?

Dr. Ziad Francis, a visionary educator in the field of algorithmic trading, will guide you through this comprehensive course. You'll develop the skills to construct risk-aware trading systems, armed with the Monte Carlo method. Whether you're new to trading or looking to refine your approach, this course equips you with a data-driven and scientifically grounded strategy for achieving trading success.

Enroll in "Mastering Monte Carlo Backtesting for Profitable Trading Strategies" today and step into the realm of informed, strategic, and profitable trading! 💼🚀

🎉 Join us and transform your trading approach from luck-based to science-backed with Monte Carlo Backtesting! Learn more and enroll now!*

Course Gallery

Loading charts...