Ultimate Venture Capital: How to model investment rounds

Why take this course?

🌟 Course Title: Ultimate Venture Capital: How to Model Investment Rounds

🚀 Course Headline: The #1 Course for Aspiring VCs, Startup Founders, Angel Investors, and Financial Analysts!

Introduction: Have you ever felt like you're just scratching the surface when it comes to venture capital and investment modeling? You're not alone. Over the years, I've noticed a common theme among both startup founders and investors: a lack of deep understanding of the capital table and its implications on ownership, economics in negotiations, and the intricacies of financial returns in liquidity events.

Why This Course? As a seasoned professional, I've seen too many brilliant minds stumble at these hurdles. That's why I've crafted this comprehensive course to demystify the world of venture capital finance. Ultimate Venture Capital: How to Model Investment Rounds is your key to mastering the economics behind early-stage capital investments, from understanding the cap table to navigating complex financial models with confidence.

Course Highlights:

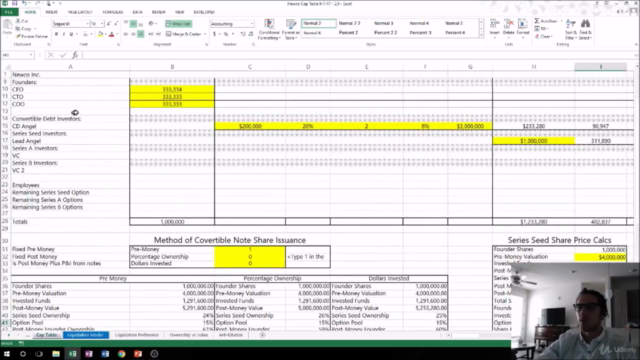

- In-Depth Understanding of Cap Table Dynamics: Learn how to model future rounds and what key economic terms mean in your term sheet negotiations.

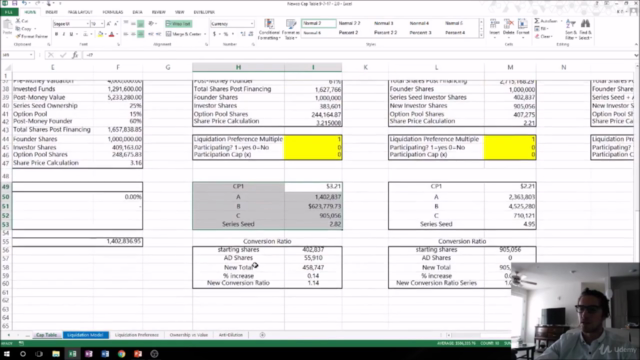

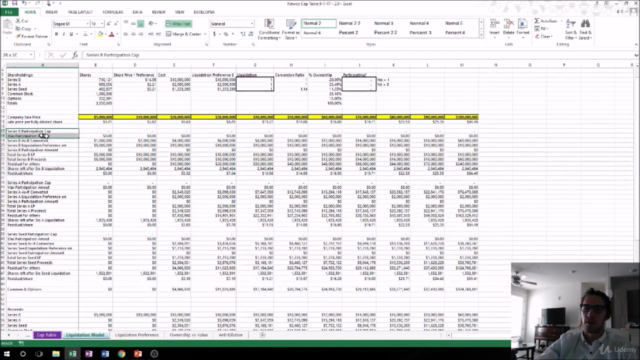

- Liquidity Events Explained: Discover how waterfall models work and what liquidation preferences truly signify for your returns.

- Hands-On Learning with Excel: This course is a roll-up-your-sleeves experience. We'll dive into Excel to get your hands dirty and ensure you emerge with a solid grasp of the concepts.

- Real-World Application: The skills you'll learn will not only save you time and money on legal fees but also enhance your negotiation power, maximize your company's value, and potentially boost your investment returns.

Course Structure:

- The Cap Table Deep Dive: Grasp the fundamentals of cap tables and how they impact ownership and economics.

- Modeling Future Rounds: Learn to project your company's growth with accurate financial models.

- Negotiation Tools: Gain the knowledge to negotiate term sheets with confidence, using key economic terms to your advantage.

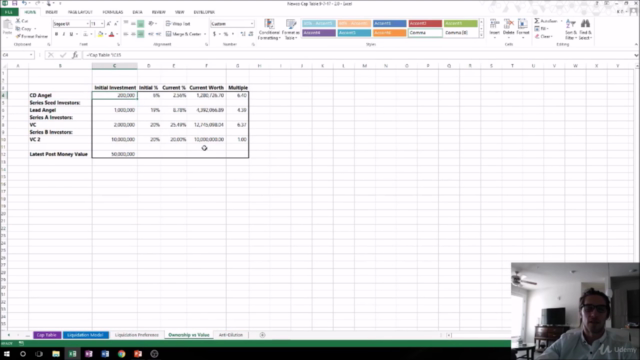

- Investment Returns and Structuring Deals: Understand the mechanisms of liquidity events, waterfall models, and liquidation preferences to maximize returns for investors.

- Excel Mastery for VC Models: Hands-on instruction in Excel with a focus on the specific functions needed for venture capital modeling.

Who Is This Course For?

- Entrepreneurs and Startup Founders who want to maintain control over their company's financial future.

- Aspiring Venture Capitalists looking to understand the nuts and bolts of early-stage investing.

- Angel Investors seeking to enhance their investment strategy and returns.

- Financial Analysts aiming to expand their skill set into venture capital financing.

Prerequisites: While this course is not an advanced Excel tutorial, a foundational knowledge of Excel will be beneficial. If you're new to Excel, I recommend a basic course to get up to speed before diving in.

Conclusion: Enroll in Ultimate Venture Capital: How to Model Investment Rounds today and join a community of professionals committed to mastering the art of venture capital finance. Don't let complex financial structures dictate your company's trajectory or your investment outcomes. Take control, learn the system, and become a savvy player in the world of venture capital. 📈🚀

Enroll Now and Transform Your Financial Future!

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

This course, while highly-regarded with a 4.3 global rating, seems to be best suited for those who already have a basic understanding of finance, term sheets, and VC concepts. The main strengths include the practical exercises and real-world application demonstrated throughout the course, which can provide students with a solid foundation in modeling investment rounds and analyzing cap tables and waterfalls. However, there are potential drawbacks for beginners and those lacking background knowledge, as some users mentioned that both the pace of the course and lack of detailed explanations might be challenging. Furthermore, access to Excel templates or files would further augment the learning experience and help to solidify fundamental concepts, but they appear to be unavailable or difficult to locate based on some testimonials. In conclusion, this Ultimate Venture Capital course serves as an excellent opportunity for individuals with prior financial expertise to enhance their skills in VC modeling, valuation, and investment rounds analysis while offering room for improvement in the areas of explanation and accessibility for beginners and those with fewer pre-existing skills.

What We Liked

- Comprehensive course covering venture capital (VC) finance and investment modeling

- In-depth exploration of cap table and waterfall analysis from scratch

- Covers various types of investment structures, valuation, and PE/VC acumen

- Practical and hands-on approach to building financial models

Potential Drawbacks

- Fast-paced delivery requires careful note-taking or rewinding for clarification

- Limited explanation of underlying concepts and terminology

- No available Excel templates in resources section (as mentioned by some users)

- Assumes some existing financial and PE/VC knowledge