How to Read Financial Statements: Build Financial Literacy.

Why take this course?

📘 Course Title: How to Read Financial Statements: Build Financial Literacy

🚀 Course Headline: Read financial statements and speak the language of business without the drudgery of a traditional accounting course!

Understanding Financial Literacy in Today's World

In today's fast-paced business environment, financial literacy is not just an advantage—it's essential. Alan Greenspan, the former Chairman of the U.S. Federal Reserve, once remarked:

This course is designed for anyone who wants to enhance their understanding of business by learning to read and comprehend financial statements, regardless of whether you have a background in accounting. Whether you're an entrepreneur, salesperson, marketer, manufacturer, purchaser, accountant, financier, lawyer, or consultant, mastering the language of finance will equip you with invaluable tools for better decision-making and greater success.

💡 The Importance of Financial Statements

Financial statements are the lifelines of any business, offering a comprehensive overview of its financial health over time. They serve as scorecards for performance and maps for navigating the company's past, present, and future. In an era where accountability in finance is under the microscope—thanks to lessons learned from Enron and WorldCom—understanding financial statements has never been more critical.

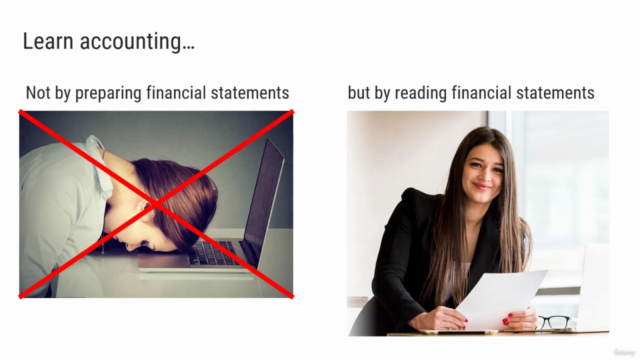

👍 Learn to Read, Not Prepare Financial Statements

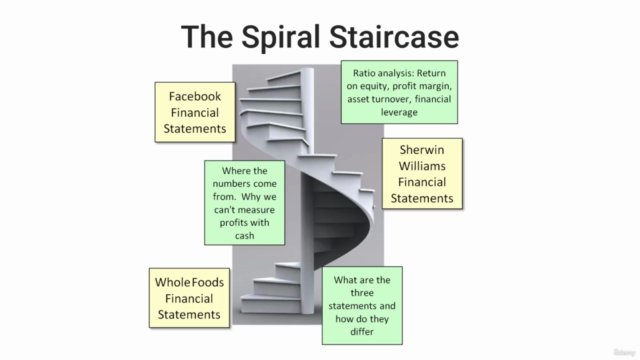

You don't need to be an accountant to read and understand financial statements. This course focuses on the end product of accounting: reading, not preparing, financial statements. It simplifies the process by eliminating the bookkeeping aspect, allowing you to concentrate on the essentials. Like mastering a spiral staircase, I will guide you through reading three real company's financial statements—Whole Foods, Sherwin Williams, and Facebook—starting with the basics and building up to a more complex understanding.

Course Outline & Topics Covered:

-

Read Financial Statements

- Understanding the balance sheet, income statement, and statement of cash flows.

-

Quick Look: Read Whole Foods’ Financial Statements

- Identifying major line items on Whole Foods’ financial statements.

-

Accrual Accounting Basics

- Exploring basic accounting concepts, the limitations of using cash to measure profits, and the need for separate statements for income and cash flow.

-

Deep Dive: Read Sherwin Williams’ Financial Statements

- Detailing what each line item signifies on Sherwin Williams’ financial statements.

-

Test What You Have Learned: Facebook Case Study

- A 28-question quiz to test your understanding of Facebook's financial statements, complete with feedback.

-

What the Financial Statements Tell You Through Ratios

- Interpreting a company’s performance using key ratios like return on equity, profit margin, asset turnover, and financial leverage.

- Compute these ratios for Sherwin Williams and analyze their annual report for deeper insights.

- Comparing financial statements across different industries.

This online course comprises 20 short videos (3-8 minutes each), followed by multiple-choice quizzes. The Facebook case study is provided to put your newfound knowledge into practice. In total, the course requires approximately 130 minutes of viewing and completing the quizzes for a comprehensive understanding of reading financial statements.

📅 Ready to Embark on Your Financial Literacy Journey?

Join us in this engaging course and unlock the secrets of financial statements. With expert guidance, interactive content, and practical case studies, you'll be equipped to navigate the financial landscape with confidence and clarity. Let's dive into the world of finance together! 🚀💼📈

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

A solid foundation builder for understanding financial statements, this course shines with its real-world examples and comprehensive coverage. Some dryness and pacing concerns do not deter from the overall value gain for beginners seeking to grasp fundamental concepts.

What We Liked

- Comprehensive coverage of financial statements and their components

- Real-world examples and company-specific information for contextual understanding

- Clear, concise language with great slides to enhance grasp of key elements

- Excellent tools provided for analyzing financial statements

Potential Drawbacks

- Delivery seemed dry and unengaging to some learners

- Cadence, tone, and grammar could be improved in lectures

- Additional company-specific information sometimes presented in a distracting manner

- Pace through slides in explanations might be too fast at times