Investing The Lazy Investor Way

Why take this course?

🌟 Unlock Your Financial Potential with The Lazy Investor Way!

Investing Success Made Simple

Join 2500+ Students on a Journey to Financial Freedom 🚀

Course Title: Investing The Lazy Investor Way

Headline: Investing Success In Mutual Funds, ETFs, Stocks - Without Becoming A Financial Guru. Be A Better Investor And Have A Life!

Course Headline: The Lazy Investor's Guide to Wealth

Investing the easy way is no longer a myth. With "Investing The Lazy Investor Way," you can achieve your financial goals with minimal effort and maximum returns. This comprehensive course is designed for individuals who want to invest without spending countless hours researching or managing their portfolios. 🏦✨

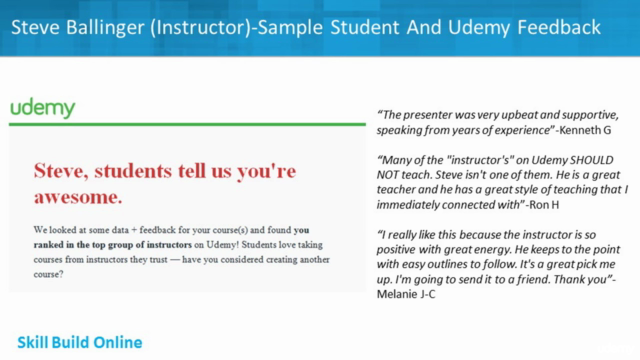

About the Instructor: Steve Ballinger, MBA

Steve Ballinger has been successfully investing using the lazy approach for years. As an experienced MBA and seasoned investor, Steve is here to share his insights and strategies so you can replicate his success in your own investment journey. 🤝

Course Overview:

-

Real-World Success Principles: Learn from a real-life investor how he makes money and how you can apply these principles to your investments.

-

Tailored Portfolio Fits: Discover which investment portfolio suits your lifestyle, risk tolerance, and financial goals.

-

Risk and Reward Management: Understand the essential balance between risk and reward to maximize returns without exposing yourself to unnecessary danger.

-

Success Factors: Implement key factors for success that have been proven over time.

-

Investment Vehicles Explained: Get guidance on choosing from mutual funds, ETFs, and individual securities to fit your investment strategy.

-

Efficient Investment Evaluation: Learn how to quickly and easily evaluate investments to make informed decisions.

-

Sample Portfolios: Explore popular investment portfolios like the Lazy, Couch Potato, and Coffeehouse portfolios that you can customize for your needs.

-

Cost Management: Keep your expenses low with tips on how to optimize your investment costs.

-

Robo Investing & Theme Investing: Understand how to use robo-advisors and thematic investments to automate your investing process.

-

Next Steps + Bonus Tips: Receive actionable advice and additional tips to take your investing to the next level. 🚀

Course Features:

-

High-Definition Video Lessons: Engage with hours of educational video content tailored to make learning easy and enjoyable.

-

Step-by-Step Demos: Get hands-on experience with interactive, screen-cast demonstrations that walk you through complex concepts step by step.

-

Lifetime Course Access: Gain unlimited access to the course materials and receive future updates and bonus lessons at no extra cost.

-

Quizzes for Knowledge Retention: Test your newfound knowledge with quizzes that confirm your understanding of key concepts.

-

Direct Instructor Engagement: Have your questions answered directly by Steve Ballinger, your expert course instructor.

-

Supporting Links: Access a wealth of additional resources to deepen your learning and enhance your investment toolkit.

-

30-Day Money-Back Guarantee: Feel confident in your decision with Udemy's no-questions-asked return policy if you're not satisfied within 30 days.

The Joy of Investing

Investing doesn't have to be a source of stress or overwhelm. With "Investing The Lazy Investor Way," you'll see that investing can be both fun and rewarding. Embrace the simplicity and potential of this approach, and watch your financial goals become a reality without sacrificing your personal life or peace of mind. 🌱💰

Take the Next Step

Ready to transform your financial future with minimal effort? Click the "TAKE THIS COURSE" button now to start your journey with "Investing The Lazy Investor Way." 🛣️

Thank you for your interest in this course, and I look forward to guiding you through the world of easy investing. Together, let's make your financial goals a reality!

- Steve Ballinger

Your Lazy Investor Mentor 🎓💼🎉

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

Investing the Lazy Investor Way" has garnered a strong reputation amongst its 6800+ subscribers for being an informative and comprehensive course for beginners seeking understanding on various investment options. The instructor delivers content in an engaging manner, making even complex investing concepts accessible to learners. However, the curriculum could benefit from addressing more advanced investment tools and providing international investor examples outside of the US.\nWhile there are certain overlaps with other courses, students appreciate learning about asset allocation and different kinds of portfolios along with risk management strategies. With some improvements in catering better to global learners and offering more content variety for experienced investors, this course has the potential to significantly enhance its value proposition.

What We Liked

- The course provides a comprehensive overview of various investment options such as mutual funds, ETFs, stocks, and bonds.

- It is well-structured, easy to follow, and delivered in an engaging manner that keeps learners interested.

- Highly applicable for beginners who want to understand key investing concepts and apply them to their own situation.

- Includes useful insights about asset allocation, different kinds of portfolios, and risk management strategies.

Potential Drawbacks

- The course seems to contain some overlap with other courses from the same instructor, which may not be ideal for those who have already taken them.

- Some students outside of the US might find the demos and example sites less relevant since they do not accept international investors.

- There is limited discussion on bonds, dividends, and more advanced investment tools that experienced or active investors may want to explore.