Financial Modeling for Renewable Energy M&A

Why take this course?

Financial Modeling for Renewable Energy M&A: Master the Art of Sustainable Deal-Making! 🌍💼

Course Headline: Unlock the Secrets of Financial Modeling in the Renewable Energy Sector with Our Expert-Led Course! 🚀🌱

Course Description:

Welcome to the Financial Modeling for Renewable Energy M&A course - your gateway to mastering the intricate world of mergers and acquisitions (M&A) within the booming renewable energy market. This comprehensive online program is meticulously designed to empower you with the tools, techniques, and insights required to develop sophisticated financial models that are pivotal in high-stakes M&A transactions.

Why Choose This Course? 🌟

- M&A Analysis Mastery: Dive deep into the nuances of analyzing M&A opportunities within the renewable energy sector.

- Accounting and Financial Reporting: Gain a solid understanding of accounting principles that are crucial for accurate financial modeling.

- Due Diligence Expertise: Learn how to conduct thorough due diligence to identify risks and opportunities in potential acquisitions.

- Deal Structuring Strategies: Discover effective methods to structure deals that benefit all stakeholders involved.

- Financial Modeling Skills: From the ground up, learn to construct financial models that will inform investment decisions and debt structuring.

Course Highlights:

- Real-World Applications: This course is not theoretical; it's rooted in practical application, using real-world scenarios to build your skills.

- Expert Instructor Guidance: Learn from an industry insider, Greg Ahuy, who brings years of expertise in financial modeling for renewable energy M&A transactions.

- Hands-On Exercises: Engage with interactive exercises that will help you apply what you learn to actual M&A scenarios in the renewable energy sector.

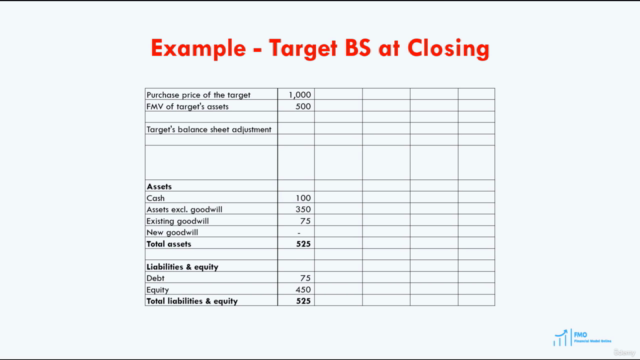

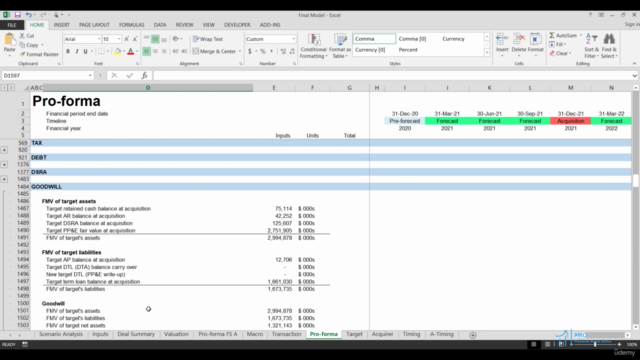

- Step-by-Step Model Building: Follow a clear, step-by-step process to develop short-form and long-form M&A financial models.

- Investment Analysis Techniques: Learn how to evaluate investment opportunities, assess returns, and make informed decisions about potential acquisitions.

- Debt Structuring Insights: Understand how to size debt financing, structure payments, and manage cash flows in the context of M&A deals.

What You Will Achieve:

By the end of this course, you will have a robust understanding of financial modeling specific to the renewable energy M&A landscape. You will be equipped to:

- Build Complex Financial Models: Construct detailed, real-life financial models for M&A transactions involving wind and solar projects.

- Analyze Deals: Assess the viability, risks, and potential of acquisitions in the renewable energy sector with confidence.

- Execute Deals: Structure and execute M&A deals with a comprehensive approach that considers financial, operational, and strategic elements.

- Evaluate Financial Models: Critically evaluate existing financial models to ensure accuracy, completeness, and relevance to M&A transactions.

Join Us on This Exciting Journey! 🌟💰

Embark on a transformative learning experience that will set you apart in the renewable energy industry. With the knowledge and skills acquired from this course, you'll be ready to take on M&A transactions with confidence and make a significant impact in the world of clean energy finance.

Enroll now and pave your way to becoming a financial modeling expert in the renewable energy M&A sector! 💡🤝

Course Gallery

Loading charts...