Financial Derivatives: A Quantitative Finance View

Why take this course?

🌟 Financial Derivatives: A Quantitative Finance View 🌟

🎯 Student Testimonials:

This course offers an unreal value. Very rich content! This beats any financial course I've taken at my university. Looking forward to completing this course and using some of these skills in my career.--Steven

Cameron is an outstanding teacher. Thank you very much for making the most important and difficult Finance concepts so easy to understand. Looking forward to the further courses.--Gevorg

I got (am getting) some intuition about quant finance, not just leaning facts without really understanding the concepts. Cameron gives nice detailed answers to students questions.--Rich

Interested in a lucrative and rewarding position in quantitative finance? Are you a quantitative professional working in finance or a technical field like data science, technology, or engineering and want to bridge the gap and become a full-on quant? This course is designed for you!

🚀 About the Course:

Instructor: Cameron Levin, former Wall Street quant, survivor of the financial crisis.

Skill Level: Suitable for those with a strong quantitative background, even if it's just high school mathematics. Logical and analytical thinkers welcome!

📚 Main Topics Covered:

- Interest rate fundamentals

- Periodic and continuous compounding

- Discounted cash flow analysis

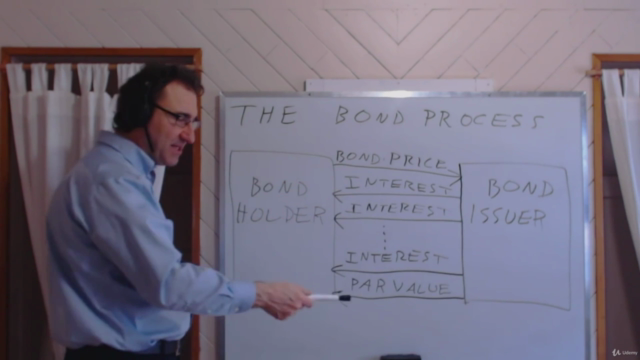

- Bond analysis

- Fundamentals of equity, currency, and commodity assets

- Portfolio modeling

- Long and short positions

- The principle of arbitrage

- The Law of One Price

- Forwards, futures, and swaps

- Risk management principles

- Futures hedging

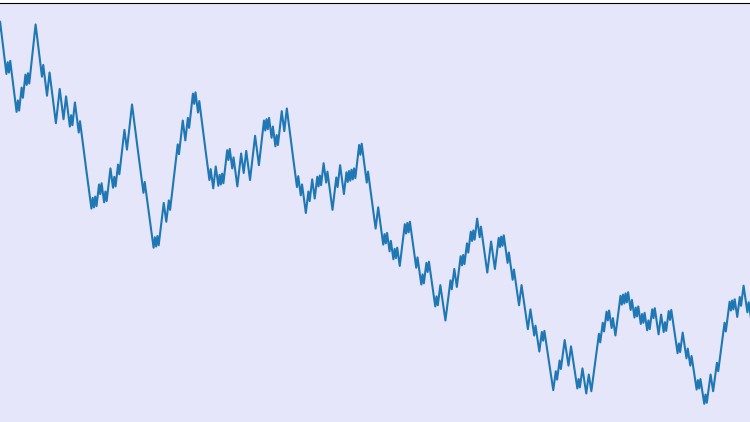

- Stochastic processes and time series concepts

- The real statistics of asset prices: volatility clustering and autocorrelation

- Fat-tailed distribution and their importance for financial assets

- Brownian motion

- The log-normal model of asset prices

- Options: understanding puts and calls

- Put-call parity

- The binomial model of option pricing

- Black-Scholes theory and formula

- Option greeks (delta, gamma, vega)

- Dynamic hedging

- Volatility trading

- Implied volatility

👨💻 Includes Python Tools:

All software included in this course is released under a permissive MIT license, allowing you to take these tools with you into your future career. Use them in open source or proprietary projects – it's up to you!

🎓 Course Materials:

- 23 hours of lectures

- 10 problem sets and solutions

- Course content equivalent to a full semester college course

- Available at a fraction of the traditional course price

- Comes with a 30-day money-back guarantee – sign up risk-free!

📆 Sign Up Now!

Accelerate your finance career by taking this comprehensive course. With detailed problem sets and solutions, you'll gain practical insights and deep understanding of quantitative finance. Don't miss out on this opportunity to elevate your financial expertise and advance into the world of quantitative finance!

📅 Enroll Today 🌟

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

An engaging and in-depth exploration of financial derivatives through a quantitative lens makes this Udemy course a worthwhile endeavor. Despite minor concerns like nonlinear structures and overly mathematical passages, the course provides substantial value in mastering complex topics with Python tools in fixed income and options. Addressing areas such as LIBOR and federal funds rate quotations can further enhance clarity for learners from diverse backgrounds.

What We Liked

- Comprehensive coverage of financial derivatives with a quantitative focus

- Effective use of arbitrage principle to enhance understanding

- Instructor's effort in answering questions and providing discussions

- Code snippets helpful for hands-on learners

Potential Drawbacks

- Some parts can seem non-linear or unclear without revisiting them later

- Explanations may be overly mathematical at times, potentially overwhelming non-mathematical backgrounds

- Occasionally lengthy content that deviates from the core course purpose

- Minor areas for improvement such as timeline illustrations and clarifying financial conventions