Payroll Accounting: Laws, Calculations, and Journal Entries

Why take this course?

🌟 Course Title: Payroll Accounting: Laws, Calculations, and Journal Entries

🎓 Course Headline: Master the complex world of payroll with practical examples, legislation insights, and comprehensive problems.

Course Description:

Embark on a deep dive into the intricacies of payroll accounting with our expert-led course designed to equip you with a mastery of payroll laws, calculations, and journal entries. As a participant, you will gain invaluable insights and practical skills that are essential for managing payroll operations effectively and confidently.

Understanding Payroll Legislation:

This course begins by thoroughly exploring the legal landscape of payroll, covering a broad spectrum of laws that govern payroll processing. From there, we delve into the specifics of payroll calculations and withholdings, ensuring your knowledge is up-to-date and compliant with current legislation.

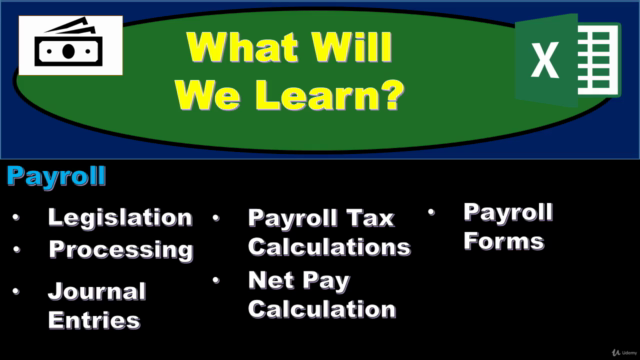

Accurate Payroll Calculations:

We understand the critical nature of accurate payroll calculations. That's why this course provides hands-on exercises to develop your skills in calculating payroll tax withholdings, including federal income tax (FIT), social security, and Medicare. You will learn how to accurately determine net pay from gross pay, a skill that is indispensable for any payroll professional.

Recording Payroll Transactions:

Often overlooked in basic payroll courses, the recording of payroll transactions is a critical component of the payroll cycle. Our course covers payroll journal entries in depth, providing a comprehensive understanding of their complexities and their impact on financial accounts, thus reinforcing your knowledge of debits and credits.

Payroll Tax Forms Mastery:

Navigating the completion of payroll tax forms can be daunting, but our course breaks down the process with step-by-step guidance for forms like Form 941, Form 940, Form W-2, Form W-3, and Form W-4. You will learn how to accurately complete these forms, ensuring your reporting is in line with all requirements.

Enhanced Learning Resources:

To ensure a well-rounded learning experience, this course offers a variety of resources including downloadable PDF files, preformatted Excel practice files, and a collection of practice questions to sharpen your problem-solving skills. Additionally, discussion questions are provided to encourage interactive learning and knowledge sharing among peers.

Expert Instruction:

You will be learning from an instructor who holds CPA, CGMA, and Master of Science in Taxation credentials, bringing a wealth of knowledge and experience to the course. Their expertise spans accounting concepts, QuickBooks software, and curriculum development, ensuring you receive comprehensive instruction and guidance.

Course Content Highlights:

- Comprehensive Payroll Laws Coverage: Understand the impact of laws on payroll processing.

- Regular & Overtime Pay Calculations: Gain detailed knowledge of how to calculate regular and overtime pay.

- Social Security & Medicare Calculations: Learn employer and employee calculations for social security and Medicare.

- Federal Income Tax Calculations: Explore the complexities of employee federal income tax calculations.

- FUTA (Federal Unemployment Tax Act) Calculations: Dive into the calculations for Federal Unemployment Tax Act.

- Other Payroll Deductions: Discover the significance of other payroll deductions in accounting.

- Payroll Journal Entries: Receive extensive guidance on payroll journal entries and their proper posting to the general ledger.

- Completion of Payroll Tax Forms: Step-by-step instructions for forms 941, 940, W-2, W-3, and W-4.

- Real-World Application: Apply your knowledge through comprehensive payroll and accounting cycle problems.

- Thorough Coverage of Payroll Definitions & Terminology: Understand key concepts and terminology used in the field of payroll accounting.

Enroll Today!

Take the first step towards mastering payroll accounting by enrolling in this comprehensive course. Elevate your expertise and gain the confidence to manage complex payroll operations with precision and accuracy. 🚀📚

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

Payroll Accounting: Laws, Calculations, and Journal Entries provides valuable insights into complex payroll processing, but is not without its flaws. While it delivers on content, with numerous practical examples and thorough coverage of key federal payroll laws and calculations, the course organization may be improved, and visual elements should be more carefully integrated to avoid distraction. Nevertheless, learners who can navigate these issues will find this course a solid foundation for mastering real-world payroll management.

What We Liked

- The course offers a comprehensive overview of payroll accounting laws, calculations, and journal entries, making it an all-inclusive resource for learners seeking in-depth knowledge.

- The practical examples used throughout the course help illustrate complex concepts and improve understanding.

- Several students appreciated the additional chapters on the accounting cycle, which provided valuable context on how payroll fits into the larger financial picture.

Potential Drawbacks

- Some students find the course layout confusing, with non-lesson content such as introductions and download prompts counted towards lesson numbers.

- The course can benefit from a major update, as certain documents are outdated (e.g., 2017 federal income tax brackets) and may not reflect current policies or regulations.

- A significant number of students mention that the excessive animations, graphics, and images are distracting and negatively impact the learning experience.